Every year, trend reports try to predict the future of grocery—but retailers already know what’s real: a product trend only matters if it moves on shelf, drives repeat purchase, and adds value to the category.

This year’s outlook from Whole Foods shines a light on what’s coming in 2026, and at Cohere Commerce, we’re already seeing many of these shifts show up in verified retailer reviews across the country.

Here’s a breakdown of what’s trending—and how these movements translate to in-store performance.

.jpg%3Ftable%3Dblock%26id%3D291f839f-f90e-80a5-a319-d37c8261e45e%26cache%3Dv2)

1. The Return of Traditional Fats

What’s trending: Tallow, ghee, and other “ancestral” fats are gaining traction as shoppers question seed oils.

Why it’s working: Health-conscious shoppers see these as “cleaner” and more minimally processed.

Retail note: Stores that educate—with signage or sampling—see higher conversion. Ingredient education matters in this category.

Whole Foods highlights Epic Provisions and South Chicago Packing as leaders in the growing beef tallow trend.

2. Fiber Is the New Protein

What’s trending: High-fiber baked goods, gut-friendly bars, and prebiotic beverages.

Why it’s working: Digestive health is now a daily priority for consumers.

Retail note: Products that call out fiber benefits clearly on the front of pack outperform those that make vague wellness claims.

In the high-fiber category, Three Farm Daughters and Sola are noted for making fiber-rich foods that still taste good.

3. Brands Backed by Real People and Real Impact

What’s trending: Products that support women farmers and transparent sourcing.

Why it’s working: Shoppers want to support real people—not faceless companies.

Retail note: Purpose-driven brands sell better when stores highlight the story behind the product, not just the price.

Whole Foods is celebrating women-led agriculture through brands like Lotus Foods, Kvarøy Arctic, True Moringa, Damya Extra Virgin Olive Oil, Fable Fish Co. Wild Alaskan Salmon Jerky, and Tomatero Farm Organic Early Girl Dry-Farmed Tomatoes.

4. Packaging That Earns Counter Space

What’s trending: Food as decor—premium tins, bold glass bottles, nostalgic design.

Why it’s working: Consumers post what they buy. Aesthetic packaging = social currency.

Retail note: Highly visual brands increase basket size as impulse add-ons.

Shelf-worthy packaging is driving sales for brands like Fishwife and Graza, which combine strong design with quality ingredients.

5. Freezer Meets Fine Dining

What’s trending: High-quality frozen meals with global flavors and short ingredient lists.

Why it’s working: Consumers want restaurant-quality meals without delivery fees.

Retail note: This category drives higher margins and brings new shoppers to frozen.

Premium frozen food is on the rise, led by Flour + Water Cacio e Pepe Pizza, Laoban Crab Rangoon, and Saiga Foods Pho.

6. Vinegar Evolves

What’s trending: Vinegar as a flavor booster, digestive tonic, and even a drink category.

Why it’s working: Bold flavor + functional benefits = versatile product storytelling.

Retail note: Expect new shelf placements, including next to kombucha and mocktails.

Vinegar is expanding beyond cooking, with brands like Ayoh! Foods (Hot Giardinayo Sando Sauce), Cabi Foods (Sweet Yuzu Vinaigrette), and Ringa (Moringa + Apple Cider Vinegar Fusion Beverage) pushing flavor innovation.

7. Natural Sweet Is Winning Over No Sweet

What’s trending: Treats sweetened with coconut sugar, fruit, or dates instead of artificials.

Why it’s working: Consumers still want indulgence—but not the ingredient guilt.

Retail note: These products perform best near grab-and-go and checkout.

Whole Foods calls out Hu Hazelnut Butter Dark Chocolate Bites as a clean-label treat sweetened naturally without refined sugar.

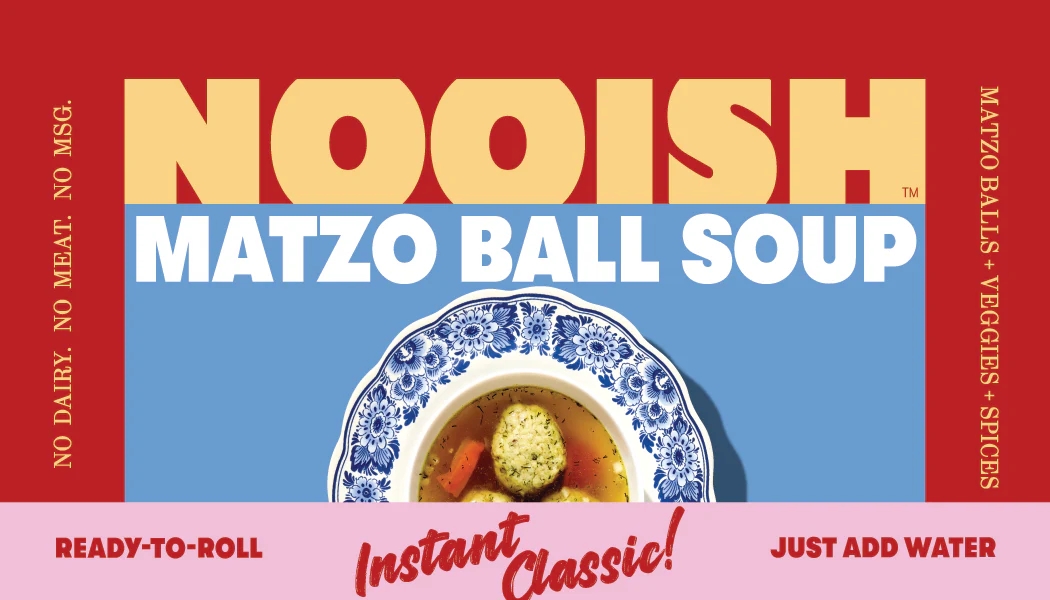

8. Convenience Without Compromise

What’s trending: Instant mixes, quick meals, ready-to-drink wellness—upgraded.

Why it’s working: Time-starved shoppers won’t trade convenience for quality anymore.

Retail note: Functional + easy is becoming a core expectation across categories.

What Retailers on Cohere Are Seeing Right Now

Across reviews from real stores on Cohere Commerce, these patterns are clear:

- Gut-focused products show strong repeat purchase

- Simple ingredient lists build trust faster than new claims

- Shelf education (signage, demos, quick claims) improves velocity

- Premium frozen and functional beverages are breakout winners

- Design-led brands earn space even in crowded categories

The biggest theme? Functionality is no longer a trend—it’s a filter. If a product doesn’t deliver a clear benefit, shoppers move on.

.jpg%3Ftable%3Dblock%26id%3D291f839f-f90e-807f-911e-d9310a4fc27e%26cache%3Dv2)

Brands You Can Explore Under These Categories on Cohere Commerce

- Tallow: My Neighbor’s Tallow – grass-fed beef tallow skincare

- Fiber: Hero Bread – 11g fiber per slice

- Women-Owned: Besto – woman-owned pesto brand

- Design-Led: Back to Nature – strong shelf presence, natural packaging

- Premium Frozen: Dam Good English Muffins – vegan sourdough (frozen)

- Vinegar: Kemushi – premium Akasu vinegar

- Naturally Sweet: Nowhere Bakery – sugar-free clean treats

- Instant Functional: Nooish – microwave-ready matzo ball soup

Share What You’re Seeing on Shelf

Every store sees trends hit differently. What’s moving in yours? What’s overhyped?

Join thousands of retailer voices shaping the future of grocery on Cohere Commerce—where shelf performance is built on real reviews, real stores, and real results.